The 6 Cases for Rare Minerals ETFs: A Structural Diversifier

4 min read

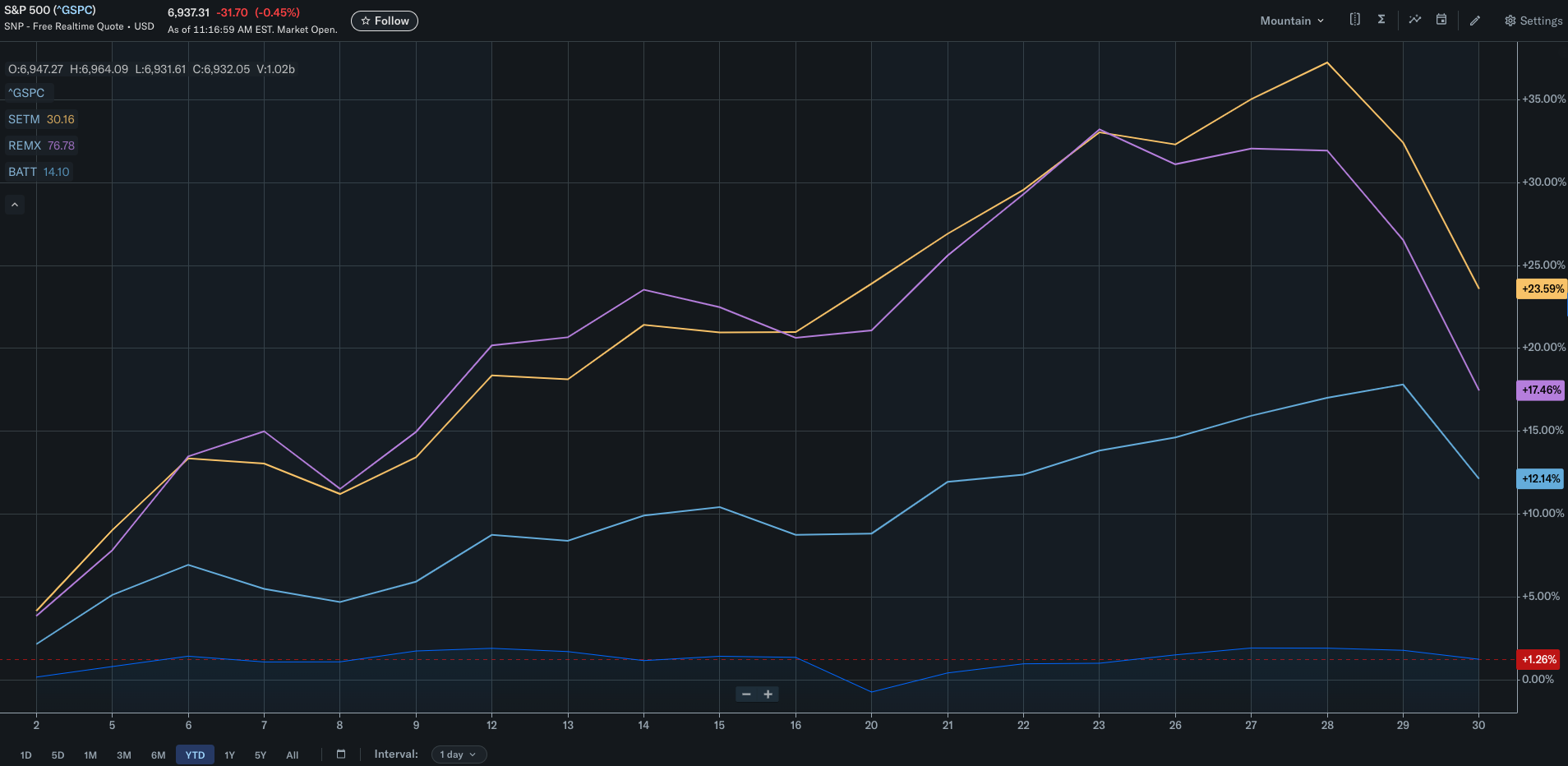

Gold and Silver continue their amazing run, ahem* even with today’s movement. Chalk it up to a mix of catalysts coinciding with the month-end rebalance. Commodities delivered standout returns in 2025 for many portfolios and still look promising going into 2026.

Many analysts have noted recent shifts in retail investor behavior, particularly notable outflows from large-cap technology funds reported by firms like Morningstar in late 2025. This trend underscores the growing importance of portfolio diversification. As capital continues to move toward value‑oriented sectors such as industrials and energy, rare minerals ETFs stand out as an appealing option. They offer exposure to a strategically important part of the global supply chain that supports clean energy, defense, and advanced manufacturing, while showing historically lower correlation to traditional equities.

Note: I said lower correlation, which doesn’t mean lower risk.

And if the market sentiment is any indication, many of you seem to agree:

$REMX: VanEck Rare Earth/Strategic Metals ETF - YTD Return: ~19.62% / 2025 Return: 87.86%

$SETM: Sprott Critical Materials ETF - YTD Return: ~25.42% / 2025 Return: 87.39%

$BATT: Amplify Lithium & Battery Technology ETF - YTD Return: ~12.89% / 2025 Return: 57.91%

Strong returns alone don’t justify an allocation. What matters is why these assets behaved differently — and whether those drivers persist once the catalysts fade. To answer that, it helps to step back from recent price action and look at rare minerals through a portfolio construction lens rather than a performance one.

1. The Diversification Challenge

Concentrated equity markets, dominated by a handful of tech giants, have left many portfolios exposed to sector-specific volatility. Broad stock and bond indices are increasingly moving in tandem during market stress, making conventional diversification less effective. Rare minerals, with returns driven by industrial demand and geopolitical factors, offer an alternative source of uncorrelated performance.

2. Understanding Rare Minerals

These ETFs focus on strategic metals that are critical to electrification, energy storage, defense, and high-tech manufacturing. Their value depends on global supply-demand imbalances, policy decisions, and industrial trends rather than consumer sentiment or macro market cycles.

3. Why ETFs?

While fees may be higher, investing through an ETF mitigates single-company risk and provides liquidity while capturing exposure to multiple operators and regions. This approach avoids the operational and permitting risks of owning individual miners and simplifies access to a complex market.

4. Low Correlation and Portfolio Impact

Because the drivers of rare mineral prices are largely structural, these ETFs tend to have low correlation with broad equities. For investors observing a rotation out of mega-cap tech, adding exposure to industrially-linked metals can act as a counterweight, smoothing portfolio volatility while participating in secular trends like the energy transition.

5. Risks to Consider

Volatility, regulatory shifts, and supply disruptions are inherent risks in commodity-focused ETFs. These funds are best used as a satellite allocation, complementing rather than replacing core holdings in equities and fixed income.

6. Strategic Perspective

From my perspective, rare minerals ETFs are not about chasing returns but about enhancing portfolio resilience. That said, recent performance helps illustrate how differently these assets can behave relative to traditional equity markets.

As noted earlier, REMX’s strong year-to-date results reflect renewed interest in materials tied to electrification, defense modernization, and industrial supply chains. These returns occurred during a period when many retail investors were reducing exposure to large-cap technology. That divergence reinforces a broader point: capital rotations, often catalyzed by policy announcements, corporate news cycles, and rebalancing flows, can surface opportunities in less crowded segments of the market.

Has this sector truly capitulated, or is today’s selloff simply part of a broader rotation? Let’s Chat.

Disclaimer: Any ETFs, securities, or investment strategies mentioned are for informational and educational purposes only. They may or may not align with BMG’s investment strategies and do not constitute investment advice, a recommendation, or an offer to buy or sell any security. All investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Investors should evaluate their own financial circumstances and consult with a qualified professional before making investment decisions