Risk Repricing Ahead? What Capital Flows and the Yield Curve Are Telling Us

3 min read

In recent quarters, two narratives have dominated financial media: massive inflows into private equity and alternative credit — and the relentless euphoria around AI and thematic growth names. Against this backdrop, the yield curve, long inverted or flat, has only just begun to steepen following the recent rate cuts.

But what’s really driving that move? And might the structural effects of capital flows be distorting the true need for risk repricing?

On a policy level, a rate cut usually pulls short-term yields down faster than long-term ones, creating a healthy steepening. But here’s the rub: if demand for long-dated public bonds is being structurally suppressed (as capital is redeployed into illiquid private assets), the long end may be more vulnerable than it looks.

The curve steepens not because long yields are falling less — but because they’re rising. That’s what traders call a bear steepener: an unwelcome repricing driven by long-end weakness, not front-end relief.

When capital is locked up in private credit, private equity, or alternative assets, it reduces the pool of marginal buyers for long-duration Treasuries. In moments of stress, that lack of liquidity can translate into outsized moves — sellers have fewer counterparties, and yields can jump even without a growth or inflation shock. Meanwhile, fiscal issuance keeps climbing. If investor appetite is migrating elsewhere, term premiums must rise to entice demand. The result: long-end yields drift upward even as the Fed cuts.

What complicates the picture is that corporate America isn’t showing much strain. This week, banks and major corporates beat expectations again. Growth looks resilient. Momentum remains intact. So, are we barreling toward a bubble blow-off — or just cautiously enjoying the ride?

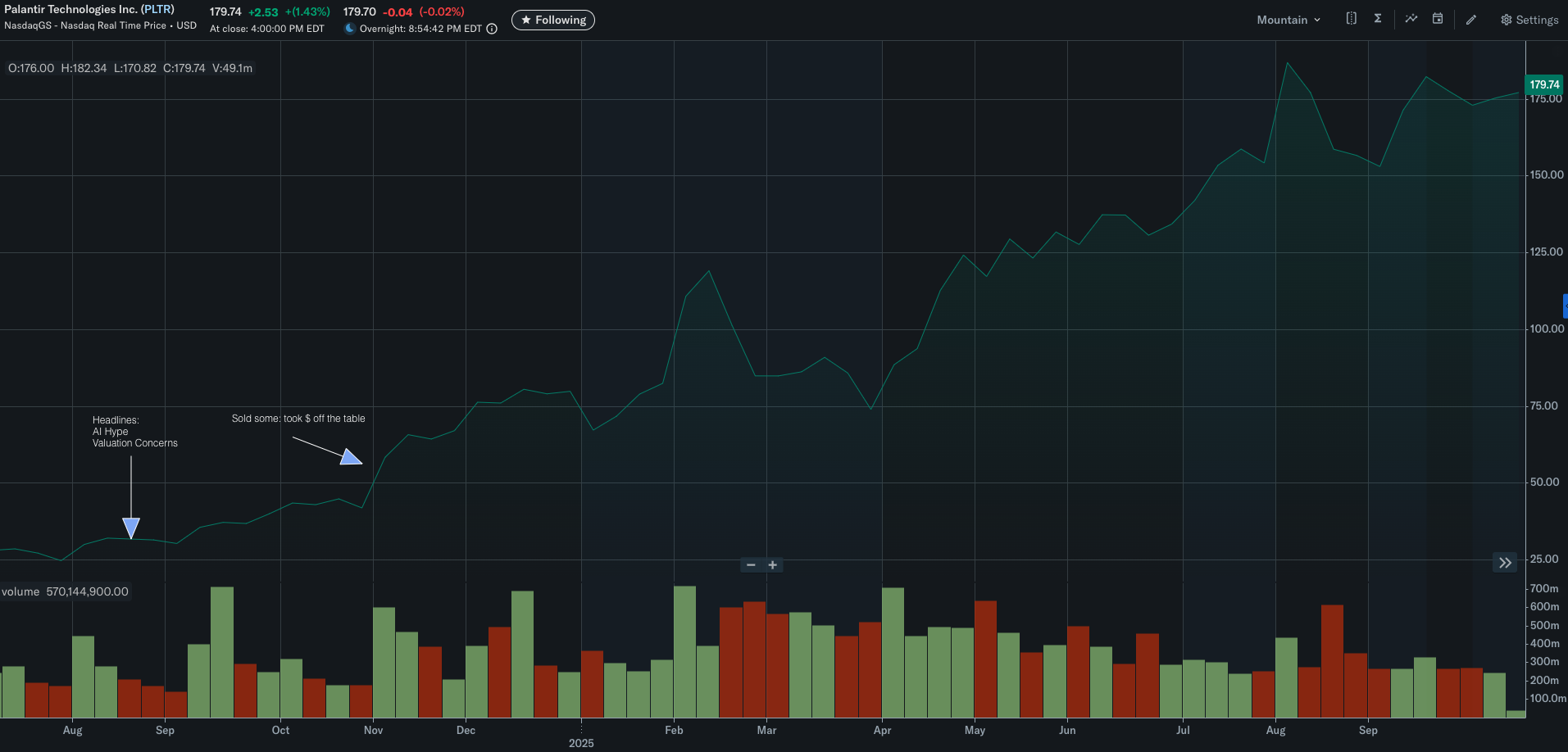

Take Palantir ($PLTR) for instance. It was trading around $20–$30 per share just two summers ago — July/August 2024. I remember the headlines screaming “Valuation Concerns” and “AI Hype.” By early fall, I trimmed that position to lower the portfolio risk. Fast-forward a year, and the stock has defied the skeptics — proving that narratives often lag reality.

Palantir’s ascent shows how quickly market narratives can flip from overhyped to undervalued — and why risk repricing is often emotional, not analytical.

The same could be said for this broader moment in markets: what looks like froth might just be structural evolution. The problem is that investors rarely know which it is until after prices move.

🧠 Translation

Normally, after a rate cut, short-term yields (like 2-year Treasuries) fall faster than long-term yields (10s and 30s). That’s a bull steepener — a sign that financial conditions are easing and borrowing costs are falling.

But today’s steepening looks different. Long-term yields are rising faster than short-term ones — a bear steepener — meaning investors are selling long bonds, pushing prices down and yields up, even as the Fed cuts rates.

⚙️ Why It’s Happening

Capital is rotating away from traditional “safe” assets into private credit, alternatives, and shorter-duration instruments.

Too much supply: Heavy Treasury issuance keeps flooding the market.

Too little demand: Investors want liquidity or the higher returns offered in private markets.

Duration fatigue: Few want to lock in for 10–30 years when policy and inflation risk feel uncertain.

To attract new buyers, long-term yields must rise.

💥 Why It Matters for Everyday Investors

🏠 Mortgage rates rise, even though the Fed is cutting.

💳 Auto and business loans become more expensive.

📉 Bond portfolios lose value, affecting 401(k)s and pensions.

🏢 Companies face higher financing costs, which can cool hiring and growth.

A bear steepener isn’t about booming growth — it’s about capital leaving the safest corners of the market, forcing yields higher. And for households, that means tighter conditions without the wage gains or optimism that normally come with expansion.

🔍 The Takeaway

When liquidity leaves public markets, it changes more than just portfolio returns — it reshapes the entire risk curve.

The headlines might say “Fed easing,” but the real story lives in how capital reallocates — and whether the next repricing is structural or cyclical.

Final Thought

Even as the Fed eases and AI optimism runs hot, the market may be quietly re-pricing risk beneath the surface. Whether that unfolds through a slow rotation or a sharp dislocation is impossible to time. But awareness is the best defense.

At BMG, our goal is to help investors understand where the real risk lies — not just in the charts or the headlines, but in the structure of the markets themselves.

📌 Because in a world where even “safe” bonds can bite, staying informed is your first form of protection.